We help Tech professionals co-invest in high-yield medical office buildings targeting 16%+ IRR with built-in tax advantages.

OpenSky Capital

Invest in Real Estate Passively. Build Generational Wealth. Live Free.

Trusted By Employees Of

$100M+

Assets Under Review

14–18%

Target Net IRR

TX. FL. AZ

Sunbelt Markets

3-5 Years

Target Hold

$100M+

Assets Under Review

14–18%

Target Net IRR

TX. FL. AZ

Sunbelt Markets

3-5 Years

Target Hold

A Smarter Way to Invest

At OpenSky Capital, we empower busy Tech Professionals and business owners to build wealth through passive real estate investing—without the headaches of direct ownership.

But it’s not just about numbers. It’s about FREEDOM. Freedom from 9-5 grind. Freedom to spend time with your family, explore your passions, or even travel the world knowing your money is working for you

We specialize in two recession-resilient sectors: Healthcare Real Estate and Multifamily Apartment Housing.

These assets provide:

Stable Cash Flow

Long-Term Appreciation

Powerful Tax Advantages

Our team does the heavy lifting—sourcing, underwriting, structuring, and managing investments—so you can focus on designing a life you love.

CURRENT OFFERINGS!

Legacy Community Health $6.15M

PROPERTY DETAILS LOCATION - STAFFORD (HOUSTON) TEXAS

Projected IRR: 16%

Lease: 16 Years, NNN

Projected CoC: 7.0%

Equity Multiple : 2X

Cap Rate: 7.12%

Hold Period: 4-5 Years

Minimum Investment: $50K

Target Closing Date: March 6th, 2026

Why Healthcare Real Estate & Multifamily?

Healthcare Real Estate

Medical office buildings, urgent care centers, dental practices,

and specialty clinics continue to see strong demand nationwide. We target top emerging markets and secure long-term (often 15+ year) leases with corporate-backed tenants. This strategy delivers consistent, reliable income—even in shifting economic conditions

Multifamily Apartment Housing

With rising population and housing affordability challenges, quality rental housing remains essential.

Multifamily properties provide:

Stable Cash Flow

Long-Term Appreciation

Powerful Tax Advantages

These asset classes offer predictable income, diversification, tax-efficient and wealth-building potential—without

the burden of managing properties yourself.

Why Choose OpenSky?

Deep Due Diligence

Our team spends countless hours analyzing each deal and partner, ensuring only high-quality investments make it to our investors.

We Co-Invest

We co-invest alongside you in every deal, aligning our success directly with yours.

Active Asset Management

Closing the deal is just the beginning.

We actively oversee each investment

to ensure the business plan is executed with discipline and precision.

Hear What Our Clients Say

“OpenSky took the time to educate us on the details and expected returns. The process was smooth, transparent, and gave us confidence in our first alternative investment.”

Prajna Shetty

“My wife and I wanted to diversify beyond stocks which also provides some tax efficiency—without getting our hands dirty. With our first quarterly check just weeks in, we already see the impact. A big step toward breaking free from the 9-to-5 grind.”

Prashant Srivastav

“The team helped us invest at our own pace, with no pressure. Their support and guidance made all the difference.”

Charles

Real Estate for Immigrants

You came here to create a better life. U.S. real estate helps you preserve wealth, generate steady income, and build a financial legacy your children and grandchildren will enjoy!

Who We Serve

Our fund is designed for:

Busy Professionals

W-2 earners seeking diversification, tax efficiency, and financial freedom.

Business Owners

Entrepreneurs looking for passive income and wealth preservation.

Accredited Investors

Those seeking access to

institutional-quality opportunities.

Whether your goal is steady income, generational wealth, or the ability to break free from the 9–5 and see the world—OpenSky

offers a proven path forward.

The OpenSky Advantage

Experienced Leadership

Decades of expertise in finance, real estate, and Fortune 100 leadership.

Exclusive Opportunities

Access to deals not available to the general public.

Aligned Interests

We invest alongside you in every deal.

Truly Passive

No tenants, no calls, no management hassles—just

professional execution.

Ready to Take the Next Step?

Take the First Step Toward Diversified Wealth.

Limited spots this quarter — secure your soft commitments before our fund closes.

Available only to accredited investors.

Frequently Asked Questions

What is the minimum investment?

The minimum investment amount is $50,000.

What is the lock-up or Hold period on this fund?

Each investment typically has a 3–5 year hold period. However, our team continuously evaluates market conditions and may pursue an earlier exit if it maximizes investor returns.

How often will I be updated about my investment?

Every investor has access to a secure online investor portal to track their investment at any time. In addition, we provide:

- Quarterly capital account statements

- Quarterly investor newsletters

- Quarterly financial statements

We also welcome direct calls with our investor relations team at any time.

Are there tax advantages?

Yes. The Fund issues annual federal Schedule K-1s to all investors. Please consult your CPA or tax advisor to understand how these may apply to your individual situation.

Can I invest with an IRA or 401K?

Yes. Investments can be made using self-directed IRAs or 401(k)s. If you don’t yet have a self-directed account, we can connect you with custodians we’ve worked with.

Note: Certain funds that use leverage may generate Unrelated Business Income Tax (UBIT). Please discuss potential tax implications with your advisor.

Do I need to be an accredited investor to invest in the fund?

Yes. We are a 506(C) offering. Only accredited investors are eligible to participate in this offering.

What qualifies as an accredited investor?

An individual or entity may qualify if they meet at least one of the following:

Individual income over $200,000 (or joint income over $300,000) in each of the last two years, with a reasonable expectation of the same in the current year;

or

Net worth exceeding $1 million, excluding the primary residence, either individually or jointly with a spouse.

Get In Touch

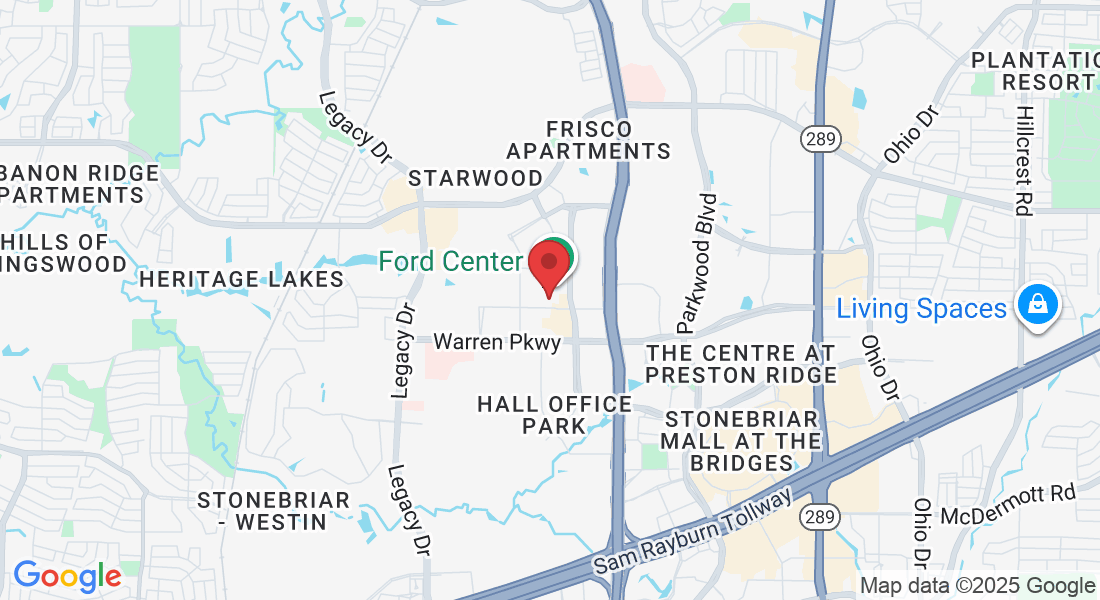

Frisco Texas USA +1.469.464.5986

Address: 5 Cowboys Way, Ste. 300, Frisco, TX 75034

Email: [email protected]

Assistance Hours :

Monday to Friday 9 to 5 p.m

Saturday 10 to 1 p.m

Sunday – Closed